IFC Markets Reviews Read Customer Service Reviews of ifcmarkets com 3 of 15

For example, a fee of 2% + 7,5 USD (or equivalent) per transaction is charged for withdrawals via debit card or credit card. For more on IFC Markets’ deposit and withdrawal methods and fees, click here. The provincial financial regulator https://forexbroker-listing.com/ for the Canadian province of Manitoba, the MSC, issued a warning against doing business with IFC Markets in April 2020. The broker does not have the required registration to offer financial services to Canadian services.

IFC Trade timing is not appropriate

CFD trades incur a minimum commission of 0.1% of the traded amount, which amounts to $0.02 per share for U.S. stocks. For more information on share commissions in other markets, click here. To evaluate brokers, we test the accounts, trading tools and services provided. Over 100 data points are considered, from minimum deposits and trading fees to the platforms and apps available.

Can I trade precious metals with IFC Markets?

IFC Markets offers a low-cost trading environment for traders willing to try its proprietary NetTradeX platform. Support is also provided for the Metatrader platforms, but trading costs remain uncompetitive. However, clients can choose to trade on over 600 financial assets, including synthetic CFDs, and even create their instruments. Regarding how IFC Markets compares to its competitors, very few forex trading platforms and CFD brokers offer as many advantages as IFC that include the ability to create your own synthetic trading instruments.

Lowest Spread Brokers

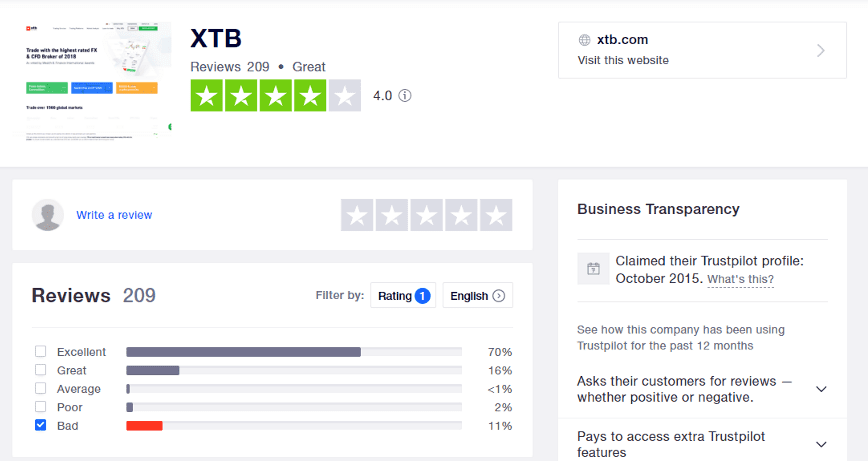

Beginner traders are inexperienced traders who have never traded before, or who have been trading for less than a year. Beginner traders often do not want to risk trading large sums of money and generally will not be able to trade full-time during the workweek. IFC Markets offers more account types than most other brokers, and its accounts are suitable for beginners and more experienced traders. On this basis, we consider IFC Markets a safe broker for British clients to trade with. Click here for more details on IFC Markets’ regulatory oversight.

- It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses.

- We also dive into each broker’s trading costs, such as VIP rebates, inactivity fees, custody fees, bid/ask spreads, and other fee-based data points.

- With everything being said, we must ask – does IFC Markets still seem safe?

- We aim to help you find the best broker according to your own needs.

- Additional standouts are the deep liquidity and ECN execution, available without commissions.

- It allows traders to create unique synthetic assets, including equity versus equity quotations, for which IFC Markets received a patent in the US.

Opening an Account

We provide investment, advice, and asset management — offerings that are mutually reinforcing and can be tailored to a client’s specific needs. A strong and engaged private sector is indispensible to ending extreme poverty and boosting shared prosperity. That’s where IFC comes in – we have more than 60 years experience in unlocking private investment, creating markets and opportunities where they are needed most.

Clients need to register with the broker to access a demo account. They provide depositing and withdrawing via cryptocurrencies easily. In short, they don’t get any commission but they get hidden spreads on positions. Another problems about this broker is that they don’t provide ECN account and they don’t execute positions fast; otherwise I deposited and withdrew several times successfully.

Forex Brokers in Canada

Additional standouts are the deep liquidity and ECN execution, available without commissions. While the MT4 and MT5 trading platforms are available as the most basic version plus the Autochartist plugin, it’s apparent that IFC Markets prefers its traders to use the proprietary NetTradeX. The implemented account structure essentially discourages the use of the MT family. IFC Markets provides a diverse trading environment with 49 forex pairs and 630 total tradeable symbols, compared to the industry average of 3,623 tradeable symbols. While the number of forex pairs is suitable for most traders, the total number of tradeable symbols is significantly below industry standards, which might limit the trading opportunities for some investors.

It also offers Autochartist for free, one of the best analysis tools on the market. The newer version of the MetaTrader platform suite, MT5 is being adopted by more traders all the time. MT5 incorporates all of the key features of MT4 and an optimised environment for EA trading. IFC Markets’ non-trading fees are average compared to other similar brokers. There is also a vast difference between the minimum deposits on the Micro accounts and Standard accounts, which start at 5 USD and 1000 USD, respectively. IFC Markets trading fees are average compared to other brokers.

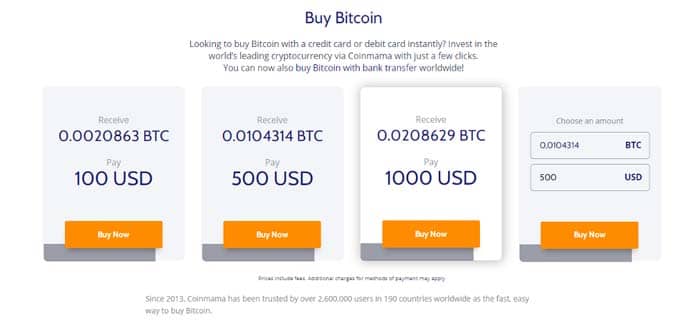

➡️Commodity Future CFDs – Over 50 commodity futures are available, allowing traders to bet on the future price of commodities. Depending on your card issuer, processing times range from ifc markets review one to five business days. ✅Enter the withdrawal amount and bank account information properly. ✅Send the specified amount from your cryptocurrency wallet to the copied address.

Or Canada, you can contact the broker via phone or request a callback. We offer impartial reviews of online brokers that are hand-written, edited and fact-checked by our research team, which spends thousands of hours each year assessing trading platforms. The broker offers several trading account options across the three trading platforms. Base currencies are the same across accounts (USD, EUR, and JPY), though accounts with the NetTradeX terminal also support UBTC payments. At the time of writing, IFC Markets offers promotions for existing clients including prize draws, commission referral rewards, and monthly bonuses dependant on trading volume.

Additionally, the broker has a 10% stop-out level to prevent negative balances and allows traders to request a larger short-margin amount for their NetTradeX accounts. NetTradeX distinguishes itself through its exceptional trading solutions, which are especially attractive to traders searching for a tailored experience. Developed by IFC Markets, this platform is acclaimed for its intuitive interface that accommodates beginner and seasoned traders. The MT4 offered is renowned in the trading community for its resilience and reliability. It boasts diverse technical analysis tools, algorithmic trading capabilities, and expert adviser utilization capacities. TradingBrokers.com is for informational purposes only and not intended for distribution or use by any person where it would be contrary to local law or regulation.

You can also earn up to 7% annual interest on the free margin money in your trading account. Above all, our experts assess whether a broker is trustworthy, taking into account their regulatory credentials, account safeguards, and reputation in the industry. As well as the proprietary NetTradeX solution, IFC Market offers MetaTrader 4 and MetaTrader 5.

Additionally, the Micro Account is an excellent account for beginner traders; its spreads are tighter, and its starting costs are lower than the entry-level accounts at other brokers. IFC Markets’ offers a wider range of accounts than other brokers, some with floating spreads and others with fixed spreads on the MT4, MT5, and NetTradex platforms. Trading costs vary depending on the account type chosen by the trader and all accounts are commission-free (click here for more on IFC Markets’ accounts). I like the trading environment at IFC Markets, as it supports algorithmic trading on all its trading platforms. It offers traders the ability to create synthetic assets via its patented Portfolio Quoting Method. Traders benefit from high leverage, excellent research, and quality education but face a minimum deposit of $1,000.

➡️Commodity CFDs – 26 commodities are accessible for CFD trading, including energy and agricultural items. Trading commodities CFDs may provide insights into global economic patterns and are frequently used for diversification and hedging. ➡️Crypto CFDs – 15 crypto CFDs are available, allowing traders to participate in the cryptocurrency market. ✅Start the transfer from your bank, ensuring all details follow the instructions.